-

General

-

Personas

-

Subscription

-

Tax

-

Investing

-

Legal

-

Products

- General Questions

- Insurance

- Life Insurance

- Umbrella Insurance

- LLC

- Series LLC

- DST

- Equity Stripping

- Estate Planning

- Land Trust

- IRA

- Self-Directed IRA

- Funding My IRA

- Managing My IRA

- Solo 401K

- C-Corp

- Banking

- Creating and Maintaining your Asset Holding Company

- Operating the Business Entity Outside of Texas

- Purchasing New Property

- Property Transfer

What is the difference between a traditional LLC and a Series LLC?

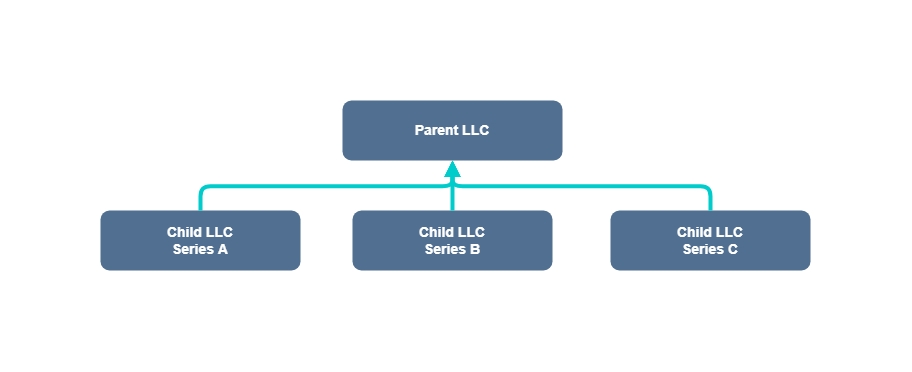

The Series LLC is a holding company that contains independent companies, or series.

In a traditional LLC, you limit your personal liability. This is great for protecting yourself from any lawsuits, debt collections or bankruptcies that are filed against your business. However, unless you establish multiple traditional LLCs, all of your business assets fall under one umbrella. Enter the Series LLC. With a Series LLC, you establish one “parent” Series LLC. Beneath this, you can form as many “child” Series LLCs are you need. This means you can compartmentalize each of your business assets. Why do this? Because, just like the barrier a traditional LLC creates between you and your business, the Series LLC creates legal divisions between your assets.

%20-%20Copy.png?height=120&name=Logo@3x%20(1)%20-%20Copy.png)